Bank Reconciliation Can Be Fun For Anyone

Wiki Article

More About Bank Reconciliation

Table of ContentsOur Bank Reconciliation StatementsMore About Bank Draft MeaningIndicators on Bank Code You Should Know6 Simple Techniques For Bank Code

You can also conserve your money as well as gain passion on your financial investment. The cash stored in a lot of savings account is federally insured by the Federal Deposit Insurance Policy Corporation (FDIC), approximately a limit of $250,000 for individual depositors and also $500,000 for collectively held down payments. Banks likewise provide credit rating opportunities for people as well as corporations.

Financial institutions make a revenue by charging more interest to consumers than they pay on cost savings accounts. A bank's size is determined by where it is located as well as who it servesfrom tiny, community-based organizations to big business banks. According to the FDIC, there were simply over 4,200 FDIC-insured commercial banks in the United States since 2021.

Standard financial institutions use both a brick-and-mortar location as well as an online presence, a new pattern in online-only banks emerged in the very early 2010s. These banks usually supply consumers greater passion prices as well as reduced costs. Comfort, rates of interest, and fees are several of the aspects that aid consumers determine their liked financial institutions.

Bank Certificate Can Be Fun For Everyone

financial institutions came under intense examination after the global financial crisis of 2008. The regulative setting for financial institutions has actually since tightened considerably as an outcome. U.S. banks are controlled at a state or nationwide level. Depending upon the structure, they might be regulated at both degrees. State financial institutions are managed by a state's department of banking or department of banks.

You ought to consider whether you wish to keep both business as well as personal accounts at the exact same financial institution, or whether you want them at separate financial institutions. A retail financial institution, which has fundamental financial services for consumers, is one of the most suitable for everyday banking. You can select a traditional financial institution, which has a physical structure, or an online financial institution if you do not want or need to literally see a bank branch.

, for instance, takes down payments as well as provides in your area, which might provide an extra customized financial partnership. Pick a practical area if you are choosing a financial institution with a brick-and-mortar location.

The Definitive Guide for Bank Definition

Some financial institutions likewise supply smartphone apps, which can be beneficial. Some large banks are moving to end overdraft account fees in 2022, so that can be an important factor to consider.Financing & Development, March 2012, Vol (banking). 49, No. 1 Organizations that pair up savers as well as borrowers aid make sure that economic climates operate efficiently YOU have actually obtained $1,000 you don't need for, say, a year and also wish to earn income from the Discover More Here cash up until after that. Or you desire to buy a residence as well as require to borrow $100,000 and pay it back over three decades.

That's where banks can be found in. Although banks do numerous points, their key role is to absorb fundscalled depositsfrom those with money, swimming pool them, as well as offer them to those that need funds. Financial institutions are middlemans in between depositors (that lend cash to the financial institution) and also consumers (to whom the financial institution provides money).

Depositors can be individuals and houses, economic as well as nonfinancial companies, or national and regional governments. Customers are, well, the same. Down payments can be readily available as needed (a bank account, as an example) or with some constraints (such as cost savings and also time deposits). While at any given minute some depositors require their cash, most do not.

Not known Details About Bank Code

The process includes maturation transformationconverting temporary liabilities (deposits) to lasting possessions (fundings). Financial institutions pay depositors less than they get from customers, and that difference accounts for the bulk of banks' income in a lot of countries. Banks can match standard down payments as a resource of financing by straight borrowing in the money and also funding markets.

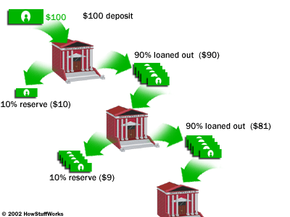

Banks maintain those required books on down payment with main financial institutions, such as the U.S. Federal Book, the Bank of Japan, and also the European Central Financial Institution. Financial institutions develop money when they provide the remainder webpage of the money depositors provide. This money can be used to purchase products and also services as well as can find its method back right into the financial system as a deposit in one more financial institution, which after that can lend a portion of it.

The dimension of the multiplierthe amount of cash produced from an initial depositdepends on the amount of money financial institutions should go on book (bank draft meaning). Financial institutions also provide and also recycle excess cash within the financial system and also create, distribute, as well bank exam books as profession safety and securities. Financial institutions have a number of means of earning money besides filching the distinction (or spread) between the passion they pay on down payments and also borrowed money and the rate of interest they collect from debtors or safeties they hold.

Report this wiki page